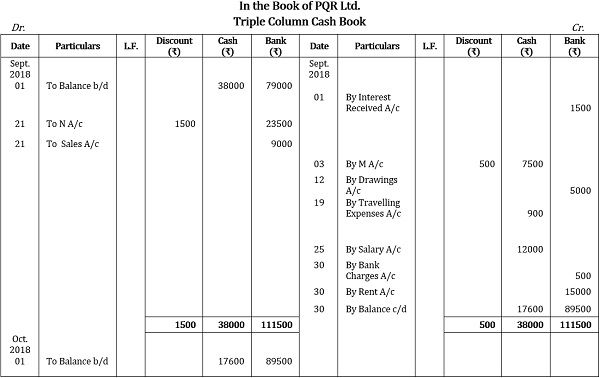

At the end of an accounting period, both columns are balanced, and closing balances are properly transferred. A triple column cash book is the most complex type of cash book. This type of cash book is used by businesses who want to track each individual transaction in the most detail possible.

- Details or narration about the source or use of funds are required in a cash book but not in a cash account.

- Triple-column cash books have two columns similar to the double-column cash book.

- Both cash receipts and cash payments are recorded in a cash book.

Cash Book and Bank Statement FAQs

To use the single-column version of the cash book, transactions are noted in one column. As before the first three columns in the diagram are the date, transaction description (Desc.), and ledger folio reference (LF). The first three columns in the diagram are the date, transaction description (Desc.), and ledger folio reference (LF). The single column referred to in the name of this cash ledger book is the monetary amount of the cash receipt (Cash) highlighted in gray. For simplicity, the single cash ledger book diagram below shows only one side of the cashbook, in this case the left hand, receipts side (debit).

Ask a Financial Professional Any Question

Cash discount is a reduction in the price charged for goods when a credit customer settles their debt within a time period given by the supplier. Cash discount acts as an incentive for credit customers to settle their debts quickly (prompt payment). Cash discount can be allowed to credit customers and received from credit suppliers. Cash books record all transactions for cash, checks, money orders, or postal orders.

Posting a three column cash book to ledger accounts

Mistakes can be detected easily through verification, and entries are kept up to date, as the balance is verified daily. By contrast, balances in cash accounts are commonly reconciled at the end of the month after the issuance of the monthly bank statement. P&G LLC records its cash and bank transactions in a triple-column cash book. The main difference between a cash book and a journal is that a cash book tracks payments and receipts. A cash book is a separate ledger in which cash transactions are recorded, whereas a cash account is an account within a general ledger. A cash book serves the purpose of both the journal and ledger, whereas a cash account is structured like a ledger.

Time Value of Money

When cash books are prepared, there is no need for cash accounts as the book serves the same purpose and can be used as a substitute. For double-column cash books, an additional column is reserved for discounts. Therefore, cash receipts and transactions are documented in one column, while the second column lists discounts received and provided.

A double column cash book is similar to a single column cash book, but it has two columns instead of one. This type of cash book is used by businesses who want to track each individual transaction in more detail. Double column cash books will show things like bank transaction what’s the difference between salary vs wage employees details. The cash book is used to record all cash receipts and payments. It contains debits and credits which are double-entry Bookkeeping entries. Debits represent increases of value or asset accounts while credits represent decreases in value or liability accounts.

There is one on each side for recording discounts, cash, and bank amounts. One column shows cash receipts and payments, the second records banking transactions, and the third notes discounts received and allowed. Keeping records of business transactions is crucial, so properly maintaining the books helps businesses run smoothly. The P&G LLC records its cash and bank transactions in a triple column cash book.

This includes both the money that has been deposited and the money that has been withdrawn. The cash flows will change with every transaction that is recorded in the petty cash book. The cash book is a chronological record of the receipts and payments transactions for a business. Therefore, the bank credits the account holder’s personal account, and the entry appears in the Cr. As a matter of practice, banks send a list of entries to each account holder that have been made in their personal account, which is maintained by the bank. Most businesses ask for their bank statement at the end of each month.

Both cash receipts and cash payments are recorded in a cash book. The cash book is also regularly reconciled with the bank statements as an internal auditing measure. A cash book is an important tool for businesses to help track their finances.

Transactions are recorded in a single column and the total amount of money received or paid out is updated at the end of each day. This type of cash book is mostly used by individuals who are tracking their personal finances. The procedure of posting entries from a cash book to ledger accounts has been explained in a single-column cash book article.