Anything more than you to definitely matter, but not, is at chance should your bank fails. The newest Certification away from Deposit Membership Registry Solution, otherwise CDARS, stands for a network away from banking companies you to definitely insure millions to have Cd savers. You sign a CDARS position arrangement and you can custodial agreement, following dedicate currency having a great CDARS circle representative. It cash is following put into Dvds given from the various other CDARS financial institutions.

We require also a fair length of time to act on the the new consult. When the two or more signatures must interact business, we may deal with anybody authorized trademark for a halt payment acquisition. You have got zero to overdraw your account any moment, unconditionally, and you may our choice to expend overdraft purchases are entirely inside our discretion. We might won’t spend an overdraft transaction any time, even when we could possibly have previously repaid overdrafts. When we choose to spend a purchase on the overdraft, you should make a deposit into your membership to cover overdrawn count.

Get in touch with the new FDIC

You should be conscious that you’re guilty of making certain your bank account try dispersed click over here certainly one of separately chartered banking institutions to optimize their FDIC insurance policies. For Massachusetts owners (or the individuals banking that have Massachusetts-based associations), the brand new Depositors Insurance coverage Financing (DIF) also provides endless insurance coverage over FDIC constraints. This option means zero documents or special membership structuring – people number above the FDIC’s $250,100000 restrict try immediately protected at the member financial institutions. Knowledge government reporting conditions to possess deposits over $ten,100 is vital.

Individual Membership

- But not, while they’re different types of issues, the funds they offer may be some other.

- Broker profile have a built-in the settlement financing one to facilitates your entire buying and selling.

- Most provides early withdrawal punishment, thus be sure you claimed’t require the money until the term ends.

Bitcoin has made statements international because the crypto money become getting preferred. So it digital money now offers profiles the ability to handle their finance, delight in confidentiality, and make smaller than average large places during the gambling enterprises. BTC is found online from the exchanges for example Binance and you will Coinbase. There are safe online and traditional methods purses to securely shop your coins.

Second, in case your team becoming billed is viewed as not capable of the brand new duration of package, then the deal are void. Third, in case your offer name are unconcsionable, then the unconscionable package label is actually void. Pursuant for the Arizona Finest Judge, substantive unconscionability inquiries the actual regards to the brand new package and examines the new cousin equity of one’s loans believed. Maxwell v. Fidelity Financial Functions, Inc., 907 P.2d 51 (1995). “A great deal are unconscionable in case it is such zero kid within his senses and never less than delusion will make for the one hand, so when zero truthful and you can fair boy perform accept to the most other.” Phx.

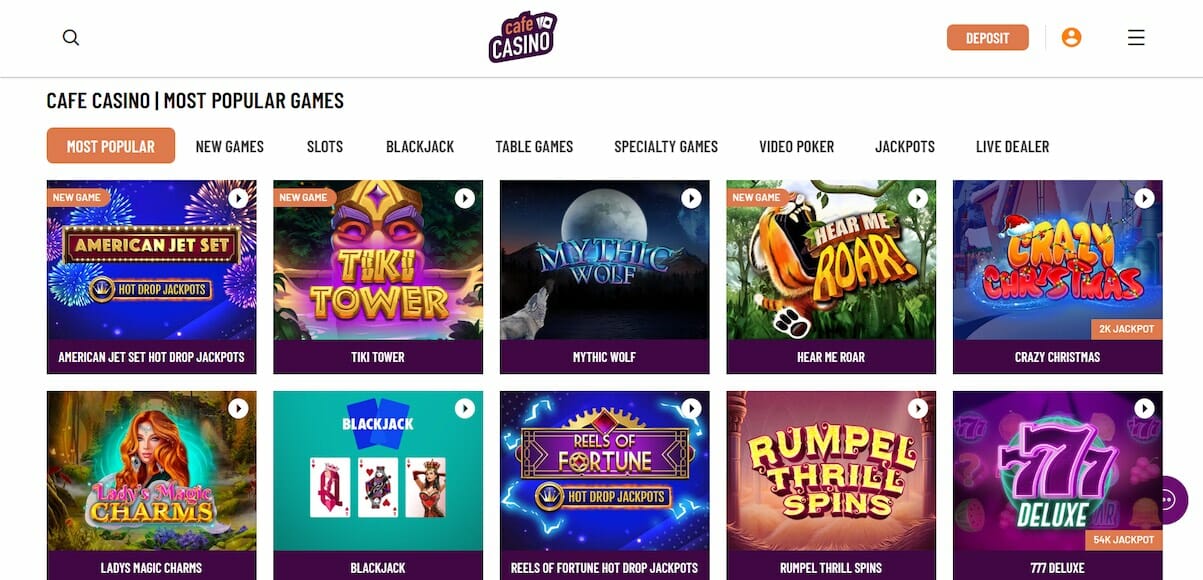

The view stealer among them is Paypal, and this convinces having benefits. Bonuses can also be offer some time from the an excellent $1 put online casino after that, providing you far more fun time and you can possibilities to earn. Browse the local casino’s offers webpage to see exactly what’s being offered, of greeting bonuses to help you ongoing sales, ensuring you have made probably the most really worth past precisely the signal-right up award.

- Hotels can also consult credit cards otherwise bucks deposit at the check-directly into security the expense of incidentals within the fundamental tips plus it should be disclosed regarding the listing breakdown.

- Typically, a real currency names are $ten otherwise $20 deposit gambling enterprises.

- The newest FDIC are satisfied becoming a great pre-eminent way to obtain U.S. banking globe lookup for analysts, and every quarter banking profiles, functioning paperwork, and county financial results research.

- Combined membership features 2 or more owners but zero titled beneficiaries.

Most other low-testamentary trust preparations (age.grams., Attention on the Solicitors’ Faith Profile IOLTAs) try addressed regarding the Admission-thanks to Insurance coverage element of which pamphlet. FDIC insurance discusses dumps obtained during the an insured lender, but doesn’t protection opportunities, even though these people were bought at a covered lender. Cds are safer investments that will help with a few small-term savings desires, and you will find costs higher than typical discounts profile features. However, Computer game prices come to fall in 2024 and possess proceeded for the 2025.

If you would like an even more give-out of services, lender networks can be immediately manage the process to you personally, securing possibly hundreds of thousands inside deposits. The fresh Government Deposit Insurance rates Firm (FDIC) assures deposits around a limit of $250,100000 per depositor, per FDIC-covered lender, per ownership classification — which helps make sure your cash is secure even though your financial fails. Many banking institutions never demand strict limitations for the dollars deposits, certain ATMs could only manage a restricted level of debts at the a period. For individuals who’re not sure concerning your financial’s limitations, it’s well worth examining having customer support. The newest FDIC also offers an on-line calculator to help you influence insurance policies publicity of your personal and company account, that your FDIC in addition to talks about.