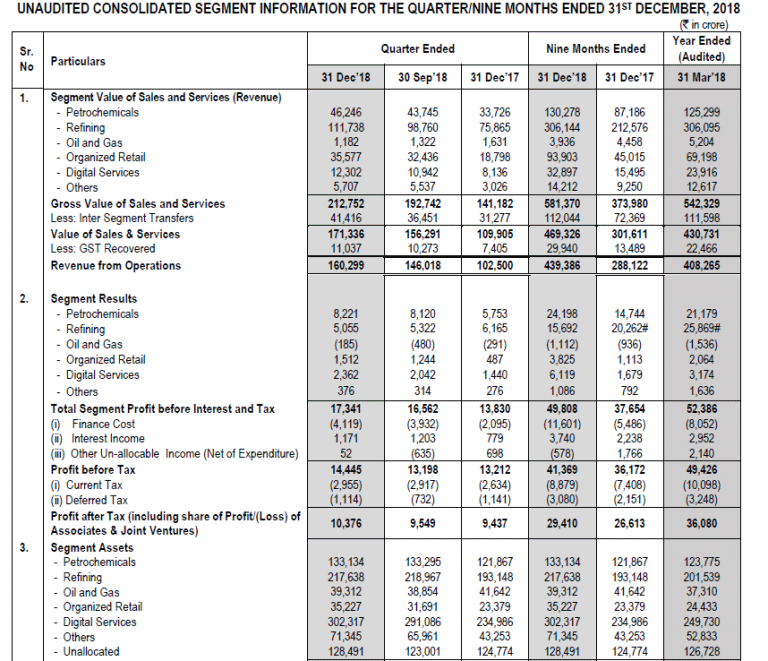

Companies that have a times interest earned ratio of less than 2.5 are considered a much higher risk for bankruptcy or default. In this respect, Joe’s Excellent Computer Repair doesn’t present excessive risk, and the bank will likely accept the loan application. Conceptually identical to the interest coverage ratio, the TIE ratio formula consists of dividing the company’s EBIT by the total interest expense on all debt securities. The ratios indicate that Company A has better financial position than Company B, because currently 50% of its total assets are financed by debt (as compared to 75% in case of Company B). Higher value of times interest earned (TIE) ratio is favorable as it shows that the company has sufficient earnings to pay off interest expense and hence its debt obligations. Lower values highlight that the company may not be in a position to meet its debt obligations.

Calculating business interest expense

The times interest earned ratio is stated in numbers as opposed to a percentage, with the number indicating how many times a company could pay the interest with its before-tax income. As a result, larger ratios are considered more favorable than smaller ones. For instance, if the ratio is 4, the company has enough income to pay its interest expense 4 times over.

Ready to save time and money?

- The interpretation is that the company is within its debt capacity with a low risk of not paying interest on its debt.

- The ratio indicates how many times a company could pay the interest with its before tax income, so obviously the larger ratios are considered more favorable than smaller ratios.

- If the debt is secured by company assets, the borrower may have to give up assets in the event of a default.

- Even though some practitioners refer to times interest earned ratio as interest coverage ratio, the interest coverage ratio is subtly different in that it is based on cash flows from operations instead of EBIT.

Keep in mind that earnings must be collected in cash to make interest payments. While the TIE ratio does not account for cash, managers must collect sufficient cash to make interest payments. However, the company only generates $10 million in EBIT during 2022, and the business pays $4 million in interest expense.

What’s an Example of TIE?

The times interest earned ratio is calculated by dividing a company’s EBIT by the company’s annual debt obligations. A times interest earned ratio of 2.15 is considered good because the company’s EBIT is about two times its annual interest expense. This means that the business has a high probability of paying interest expense on its debt in the next year. At the same time, if the times interest earned ratio is too high, it could indicate to investors that the company is overly risk averse. Although it’s not racking up debt, it’s not using its income to re-invest back into business development. In other words, the company’s not overextending itself, but it might not be living up to its growth potential.

We will also provide examples to clarify the formula for the times interest earned ratio. This source provides the 2021 median ICR ratio for a number of industries, based on publicly traded U.S. companies that submit financial statements to the SEC. To determine a financially healthy ratio for your industry, research industry publications and public financial statements. Capital-intensive businesses require a large amount of capital to operate. Banks, for example, have to build and staff physical bank locations and make large investments in IT. Manufacturers make large investments in machinery, equipment, and other fixed assets.

Calculating business times interest earned

It will distort the realistic operations of the business if the company doesn’t earn consistent revenue or it experiences an unusual period of activity. This is also true for seasonal companies that may generate unfairly low calculations during slower seasons. Every sector is financed differently and has varying capital requirements. A company may seem to have a high calculation but it might have the lowest calculation compared to similar companies in the same industry. To calculate the times interest earned ratio, we simply take the operating income and divide it by the interest expense.

We will need to take the Future Value (FV) formula and modify it to get the Present Value (PV) equation. The times interest earned ratio is a measurement of a company’s solvency. A higher calculation is often 3 5 process costing fifo method better but high ratios may also be an indicator that a company isn’t being efficient or prioritizing business growth. It’s often cited that a company should have a times interest earned ratio of at least 2.5.

You divide 72 by the return you would receive to find the number of years. As we can see in the above example, time can make a big difference as to how much money invested today can grow over time. Consider calculating the ratio several times over a specified period to determine whether it’s high.